Rabco Simple - How do I process employee withholding forms?

This guide explains how administrators can process federal and state withholding form updates submitted by employees.

How to Process Withholding Forms

Step 1: Notification and Access

- When an employee submits a withholding form (federal or state), the system sends an email notification to the administrator.

- These changes are not applied until the administrator processes the form.

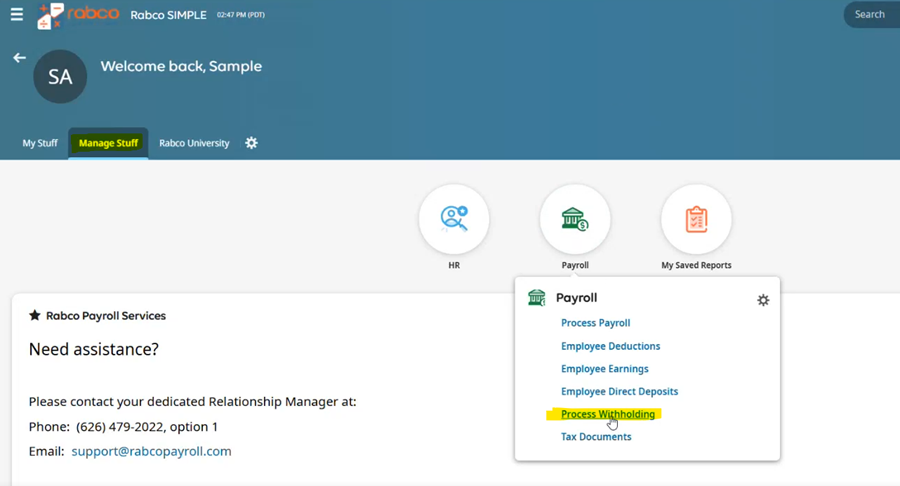

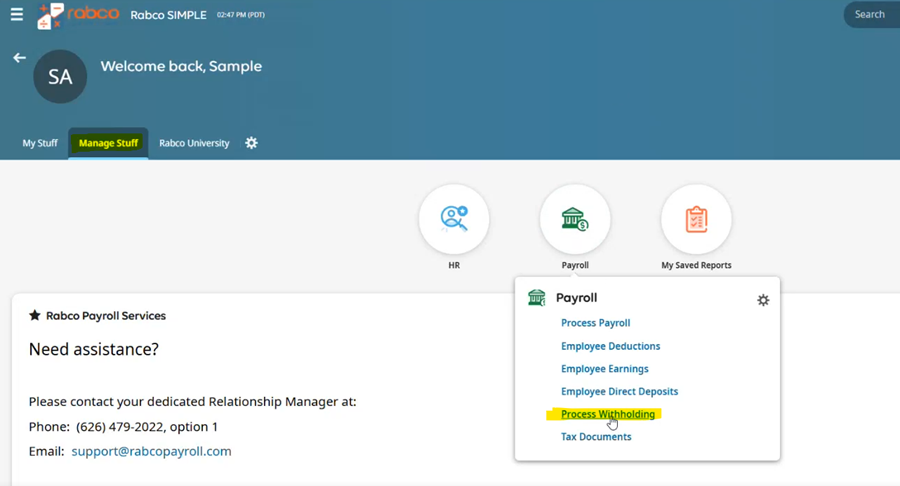

- Log in as an administrator and go to the Manage Stuff tab > Payroll > Process Withholding.

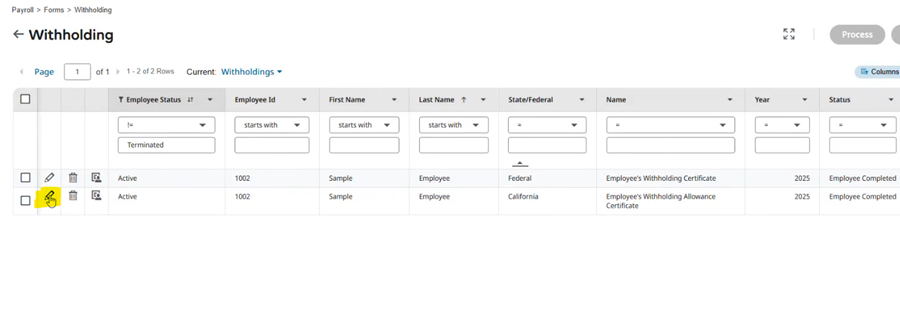

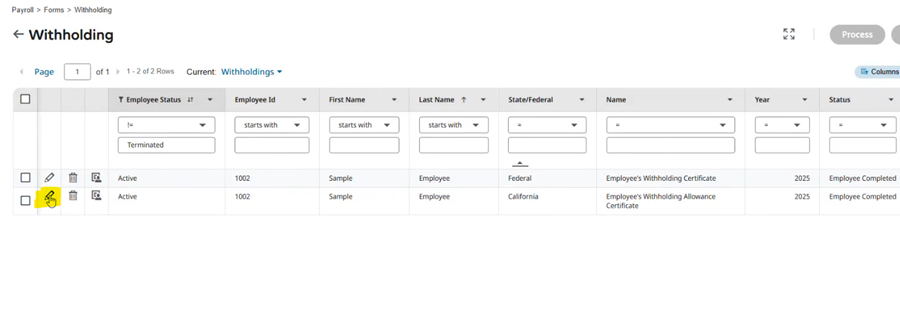

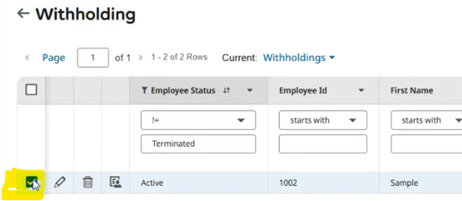

Step 2: Review Submitted Forms

- All submitted forms will be listed along with the submission date and time.

- Click the pencil icon to view the form details.

- You can download the form as a PDF if needed.

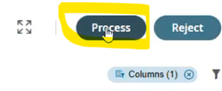

- If the form contains errors or needs updating, click Reject to have the employee resubmit.

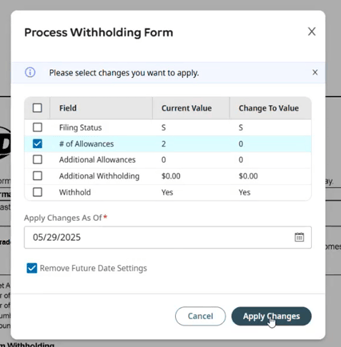

Step 3: Process Withholding Forms

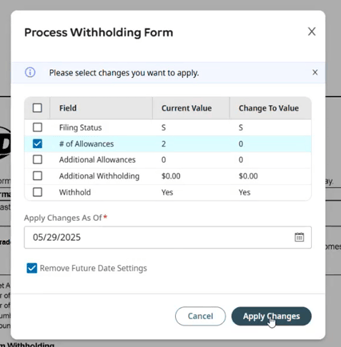

- To approve and apply the changes, click Process.

- Confirm the applicable settings shown by the system.

- If prompted, enter the date the changes should take effect and remove any future date settings if necessary.

- Enter your administrator password to confirm and complete the action.

- The form status will update to 'Processed' once complete.

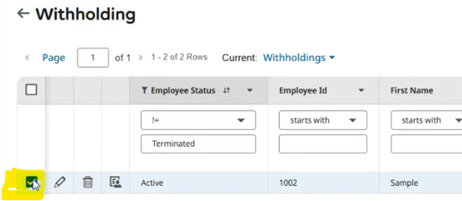

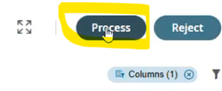

Step 4: Process or Reject via Bulk Actions

- You can select multiple forms using the checkboxes.

- Click 'Process' or 'Reject' from the bulk action toolbar.

- The same confirmation steps will apply for each selected form.

Final Notes

- Ensure all forms are reviewed and processed promptly to maintain accurate payroll settings.

- If you have questions or need assistance, contact your system support team.