Use these settings to block Federal and State withholding for an employee. If you are not able to adjust the Block W/H setting, please call our support line as your security level may need updating.

- Navigate to Select Menu

> My Team

> My Team  > Employee Information and click the

> Employee Information and click the button to select the desired employee.

button to select the desired employee. - On the Payroll tab, scroll down to the Tax Information widget.

- Select the Federal option in the Tax Information widget and click on magnifying glass.

- In the FIT (federal income tax) withholding section, select “EE Withhold” drop down, change the option from “Yes” to “Block W/H”

**IMPORTANT: Do NOT select the Exempt option! This marks the employee’s wages as tax exempt and does not report them correctly, which can create amended returns and additional fees if selected incorrectly**

- Click

in order to save the FIT tax setting.

in order to save the FIT tax setting. - Next, click on the State tab.

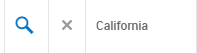

- Click the magnifying glass to the left of the tax state in order to access the detail for the state withholding.

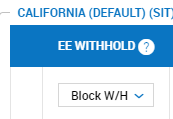

- In the SIT (state income tax) withholding section in the upper right, select “Block W/H” in the EE Withhold drop down.**IMPORTANT: Do NOT select the Exempt option! This marks the employee’s wages as tax exempt and does not report them correctly, which can create amended returns and additional fees if selected incorrectly**

- Click

in order to save the SIT tax setting.

in order to save the SIT tax setting. - These settings will block State and Federal income tax withholding, but will still report taxable wages.