This video shows you how to process an employee's withholding form in Kronos WFR. If you do not have a quick link, you are able to access the same area by selecting the Team tab > HR > Forms > Government Forms > Withholding on your main menu.

Watch the video or follow the Step by Step instructions:

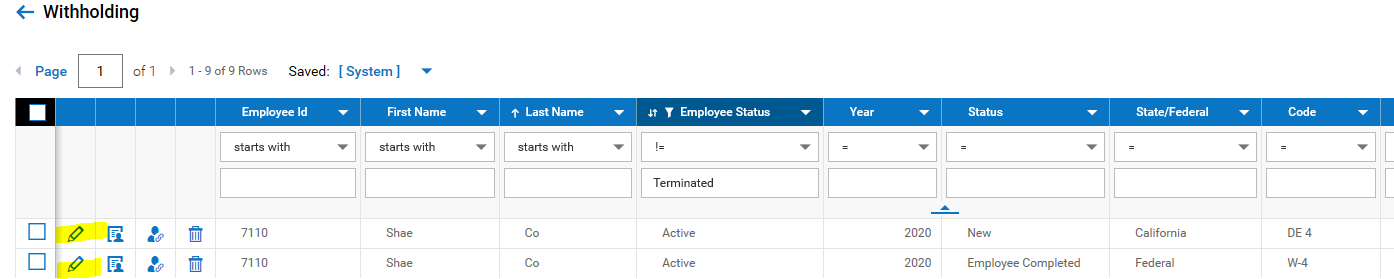

Withholding Form Statuses:

- New: This form is in a draft state. The employee has created but not submitted it.

- Employee Completed: This form has been submitted by the employee.

- Processed: This form has been processed and applied to the employees account by their manager.

To Note:

Only one type of withholding form can be processed together across multiple employees. For example, you can only process all federal withholding forms together. You can only process all state withholding forms together. You CAN'T process federal AND state together. You will receive an error.

If an employee has submitted more than one withholding form you have two options:

- Process each withholding form individually in order of submission so the last form they submitted is the last form that is processed

- Reject the older submissions and only process the most recent one.

Step By Step Instructions

- Go to Main Menu > Team > HR > Forms > Government Forms > Withholding:

- Click on the Edit button to review withholding form(s) – Note you have to process the federal and state separately:

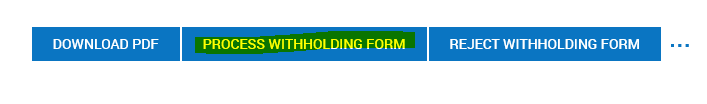

- Click “Process Withholding Form”

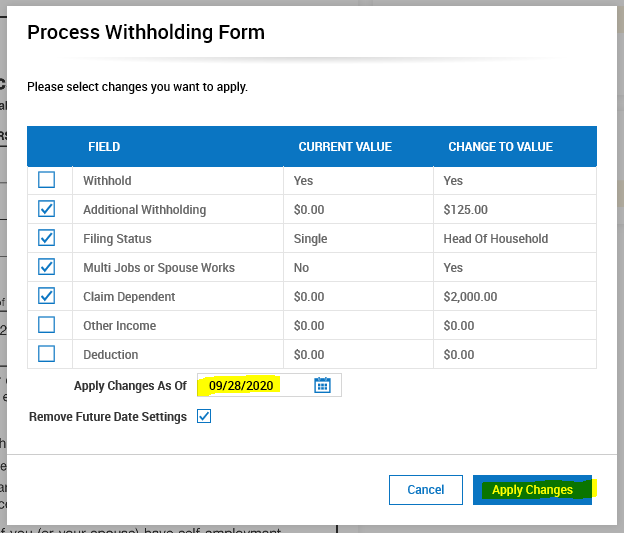

- Review the changes being made and enter future date that the change should apply on if applicable, click on Apply Changes: