If your employee has submitted a paper withholding form rather than using their login for Kronos (UKG), follow these steps to update their settings.

Navigate to: Select Menu  >Team

>Team  > My Team > Employee Information

> My Team > Employee Information

- Select the employee you wish to update.

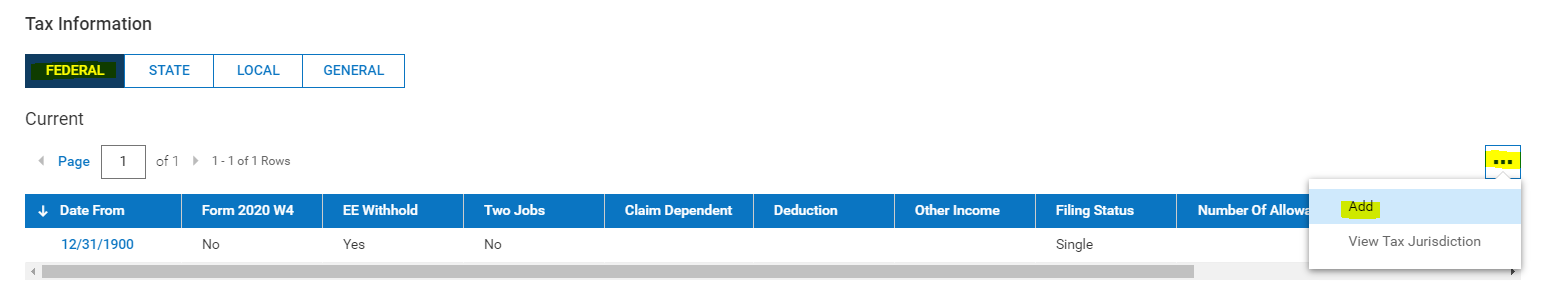

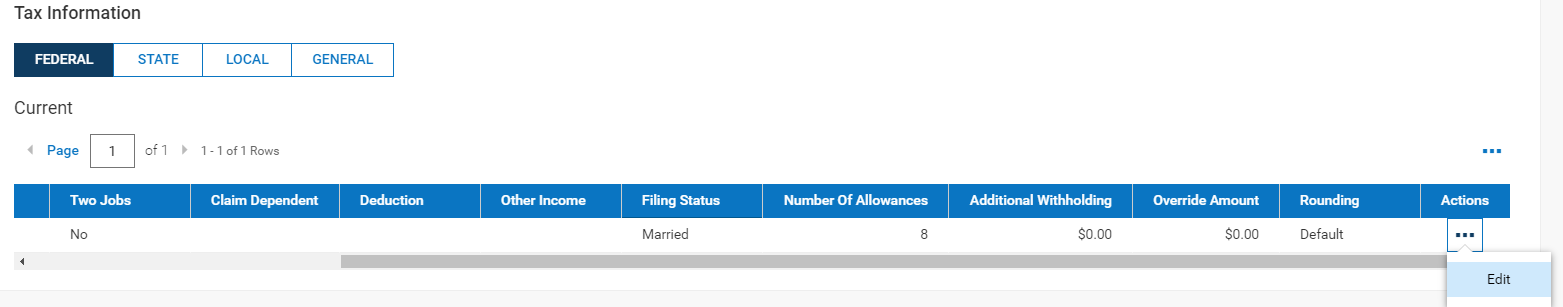

- Navigate to the Payroll tab > Locate the Tax Information widget.

- Select the Federal tab, click on the ellipsis in upper right, then Add

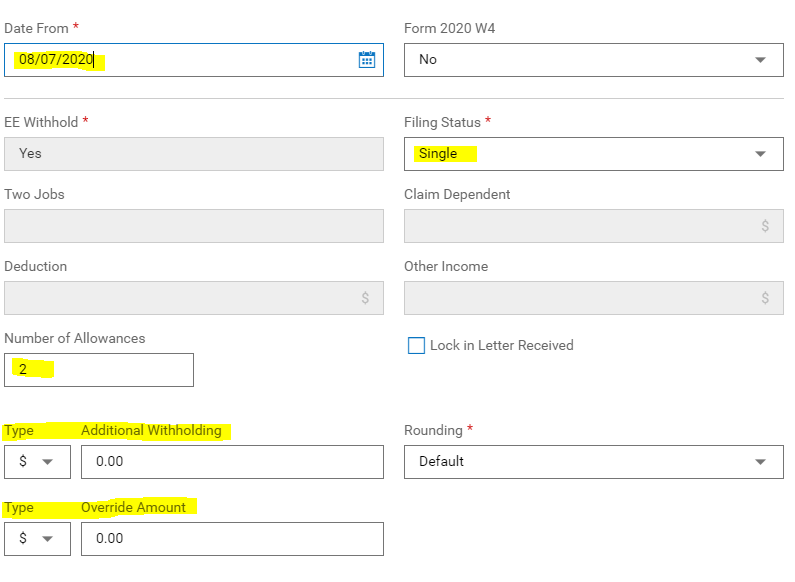

- On the pop up menu, enter new Date From active date, select correct Filing Status, enter Number of Allowances, enter any additional Withholding or Override Amounts, finishing with Save

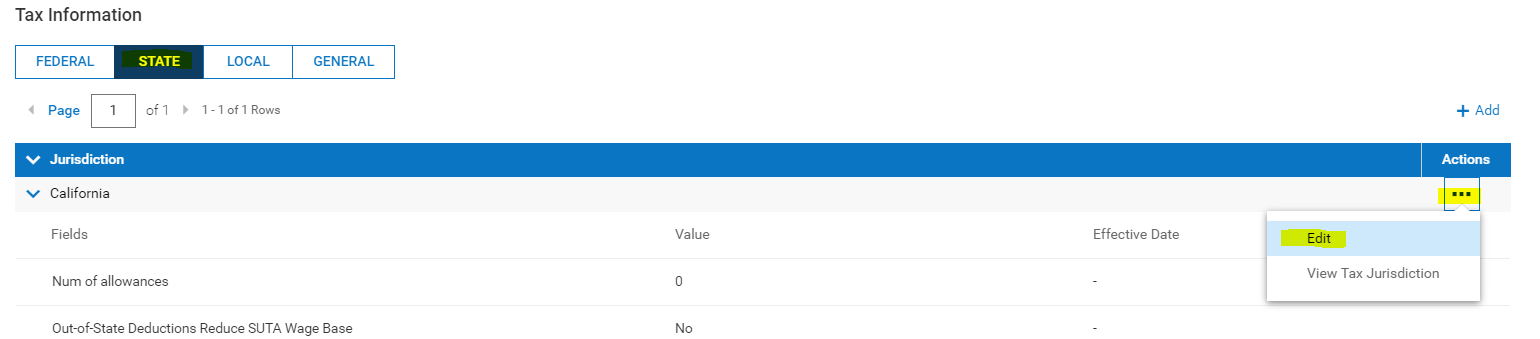

- Select the State tab, click on the ellipsis in upper right, then Add

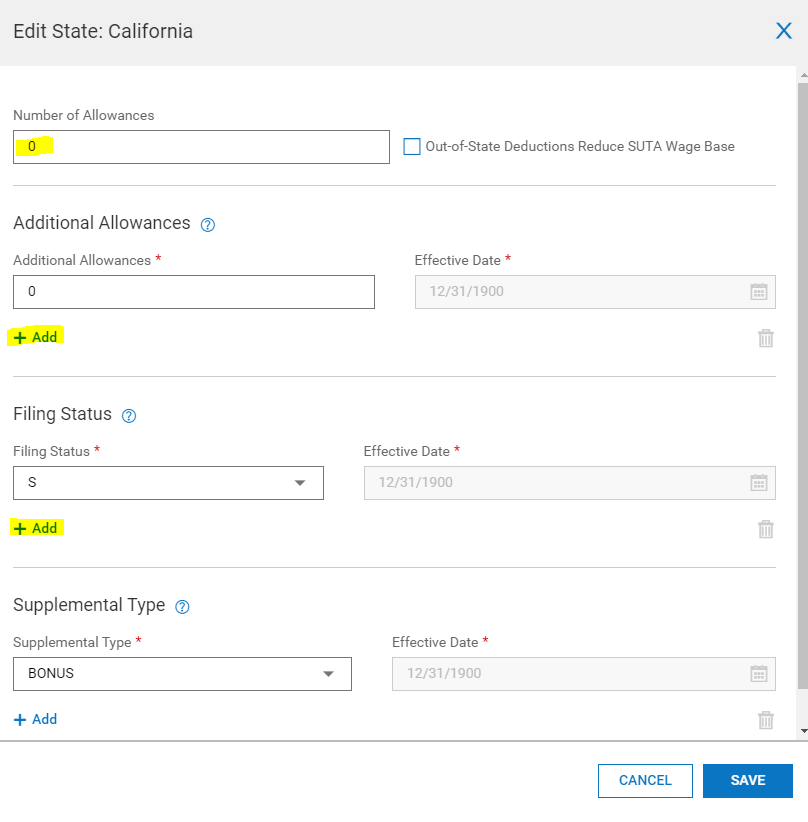

- Enter the new Number of Allowances, Add a new line for any new Additional Allowances and enter the new Effective Date, Add a new line for Filing Status and the new Effective Date if the filing status has changed, finishing with Save

- Select Save in the upper right corner of the employee’s information.

- Select the Back button to return to the employee list.

- Select the Federal tab, click on the ellipsis in upper right, then Add

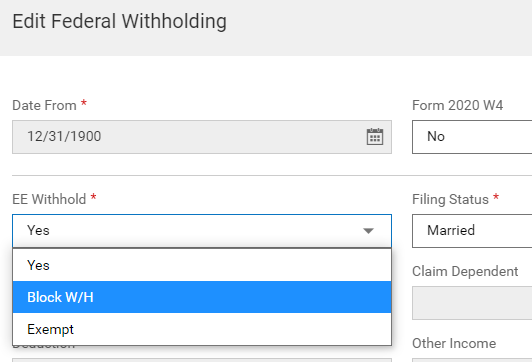

Tax Exempt setup on an Employee

- On the employees Payroll tab go to the Tax Information widget

- Highlight Federal and click on the ellipsis (

) icon under Actions all the way to the right of the row and click on Edit

) icon under Actions all the way to the right of the row and click on Edit

- Under the EE Withhold section, click on Block W/H from the dropdown and click Save

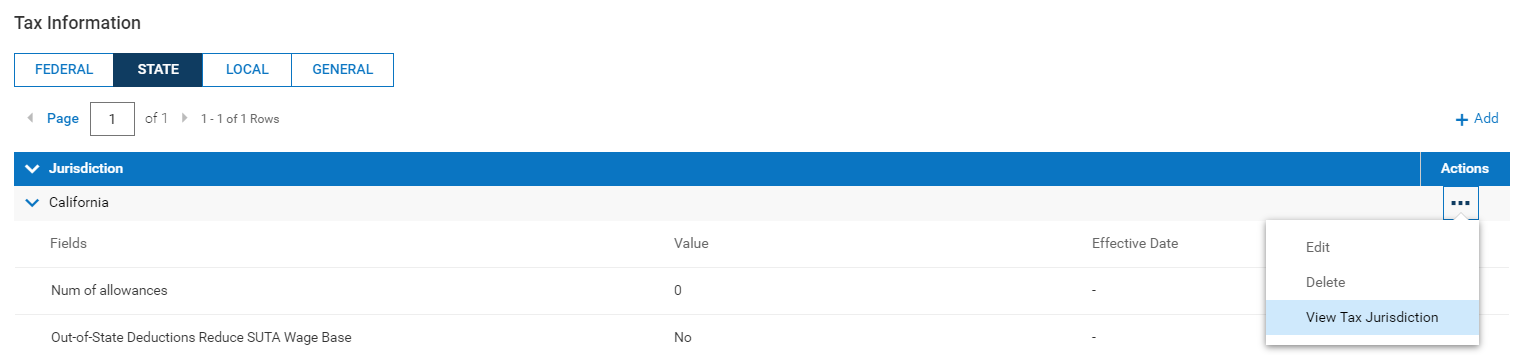

- For State, highlight the State tab and click on the

icon under Actions all the way to the right of the row and click on View Tax Jurisdiction

icon under Actions all the way to the right of the row and click on View Tax Jurisdiction

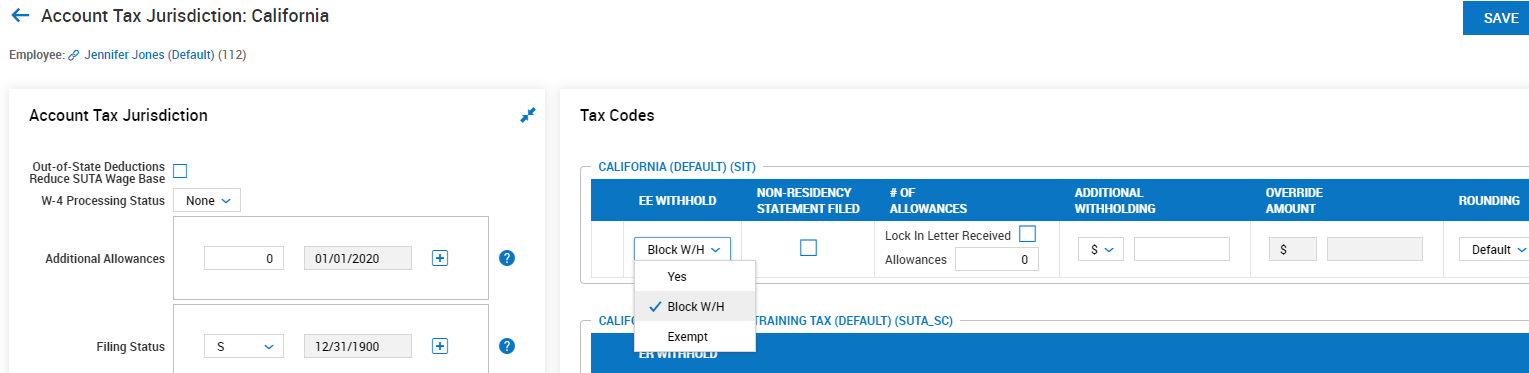

- Under the Tax Codes section, select Block W/H in the EE Withhold dropdown and click Save

Please note: if you are missing any of these settings, contact Support at

626-479-2022