Follow these steps to have Kronos (UKG) calculate weighted overtime for the company who uses only the payroll module.

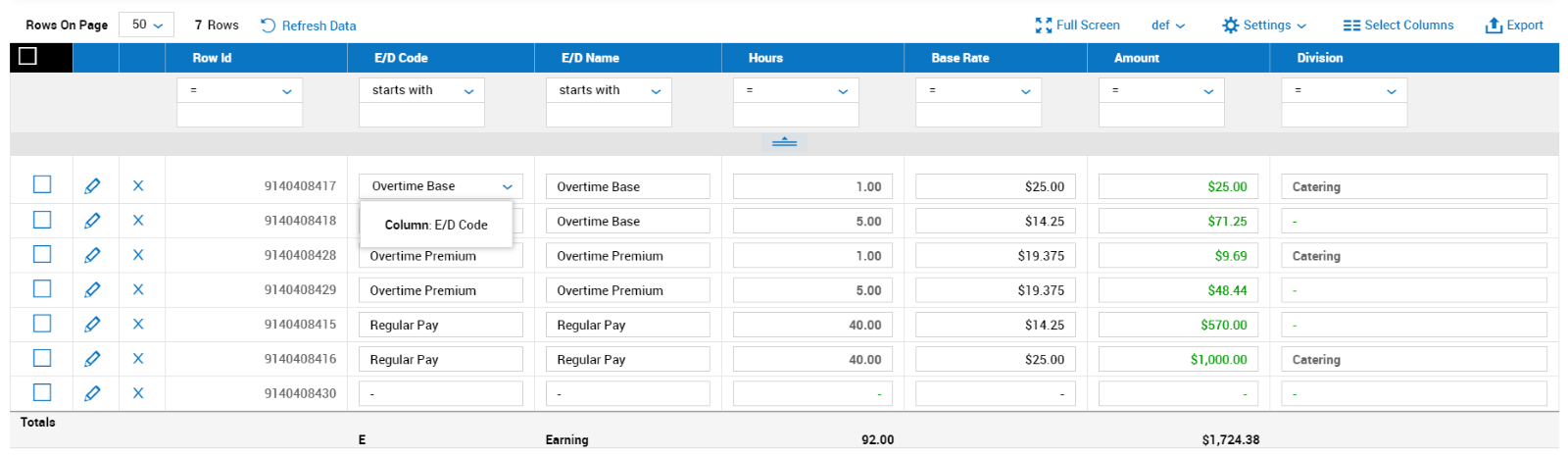

In this example, the employee earns the following:

$14.25 / Hr Base Comp

$25.00 / Hr for Catering (Cost Center)

When editing PST, the Admin enters E/D (earning/deduction code) and Hours as normal:

Regular Pay > 40 hours > No Cost Center Specified

Overtime Base > 5 hours > No Cost Center Specified

Regular Pay > 40 hours > Catering (Cost Center)

Overtime Base > 1 hour > Catering (Cost Center)

When the Admin then enters the Overtime Premium E/D, using the same OT hours indicated in Overtime Base, the system calculates the Average Premium OT Rate of Pay accordingly.

How did the system calculate $19.375 as the Average Premium OT Rate?

Total of Regular & Overtime Base Wages ($1666.25) / Total Regular & Overtime Base Hours (86.00) = $19.375 Average Premium OT Rate