If you need to create a pay statement knowing you want an employee to receive a certain amount of dollars and need to figure out taxes, use the Gross Up pay statement type to do the work for you.

- Navigate to Select Menu

> Team

> Team  > payroll > Process Payroll

> payroll > Process Payroll - Navigate to the next scheduled payroll and select

- Select Add/Edit Pay Statements

- Select New Pay Statement in the upper right corner.

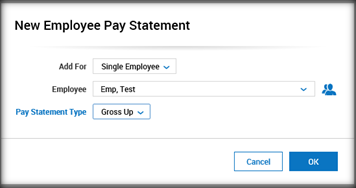

- Select the applicable employee and choose the Pay Statement type of Gross Up. Select OK.

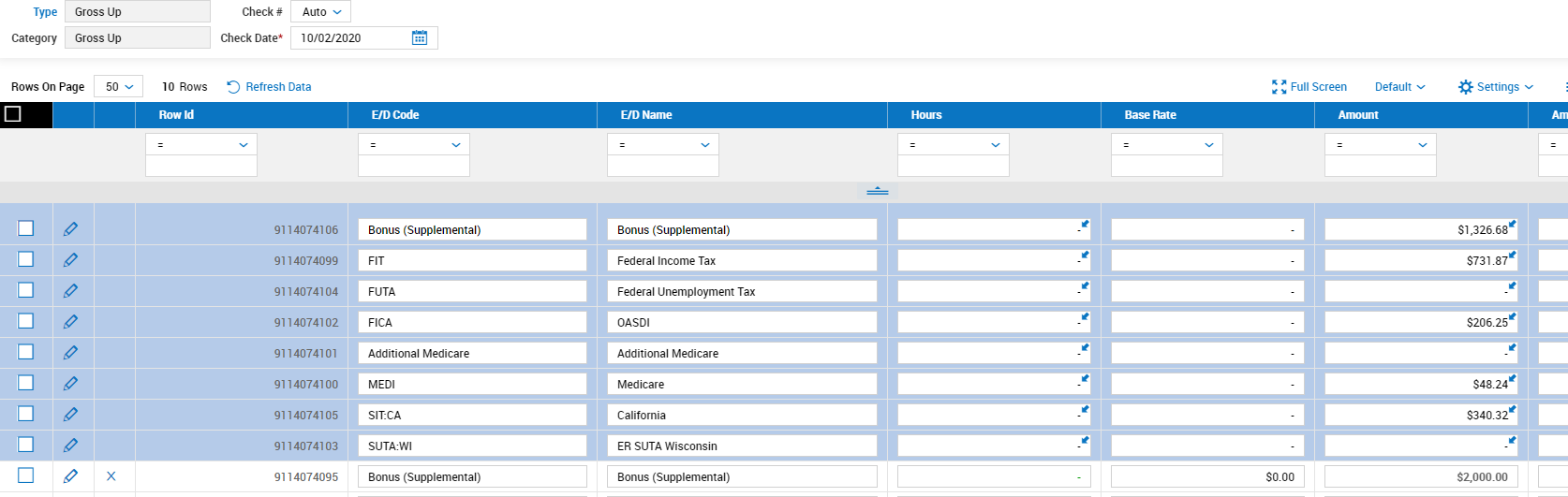

6. Choose the proper Earning code (W2 Auto, Gift Card, Bonus, etc.)

(Please note: use a code such as Reg or Hourly for GTL as Fringe Benefits do not calculate correctly on Gross Up pay statements.)

7. Enter the NET amount of the check you would like to create for the employee.

8. Select Save on the top right corner.

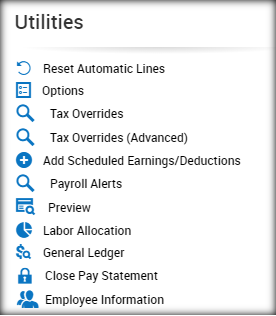

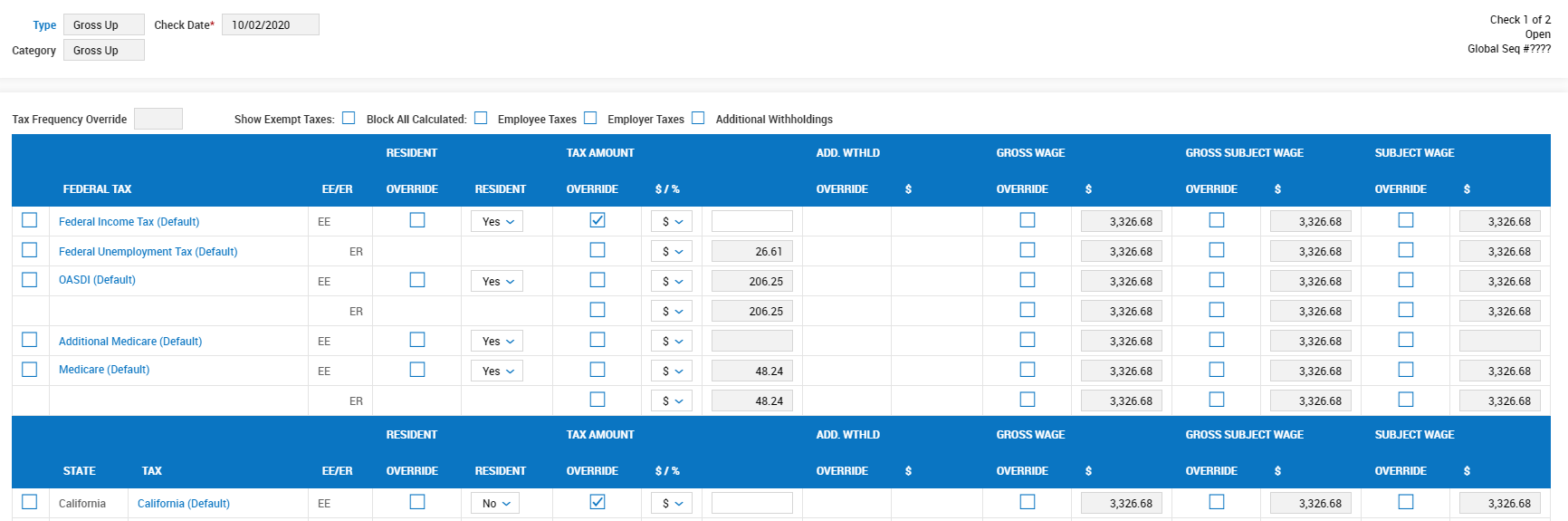

9. Select Utilities > Tax Overrides ( Advanced)

10. Adjust Federal and State Tax amounts to $0 if desired.

11. Select Preview in the edit pay statement to view the Gross amount that the check will be.

12. Write down this amount or you could print out the pay statement.

You will delete this pay statement. This was to simply to create a calculation for the gross amount of the actual check you will be issuing to the employee. See steps below to delete the pay statement.

13. Click on the arrow on the top left corner to go back.

14. Check the “X” next to the Pay Statement

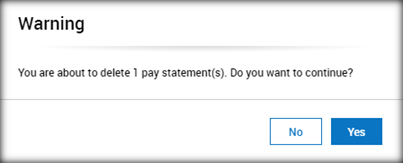

15. You will get a warning box that states ‘You are about to delete 1 pay statement(s). Do you want to continue?’ Select Yes.

16. After deleting the Gross Up Pay Statement, you can now create the actual pay statement for the employee by entering the gross amount you wrote down/printed from the Gross Up Pay Statement calculation in the above steps.