Non-benefit deductions are added through the employee’s payroll, deductions area. Benefits through an HR Benefit Plan MUST be updated on the employee’s HR tab.

1. Navigate to Select Menu > Select My Team

> Select My Team  > Employee Information

> Employee Information

2. Select the that corresponds to the employee you are selecting

that corresponds to the employee you are selecting

3. Select the payroll tab and go to the Deductions widget.

4. Select , a pop-up window will appear.

, a pop-up window will appear.

5. Select the type of deduction (i.e. 401K, Uniform, benefits (if not an HR client), etc) and then select “OK”.

Child supports, garnishments and levies should still be sent to RABco for setup

6. A pop-up screen will appear that is geared to that specific deduction code. Each section will appear a little different depending on the type of deduction.

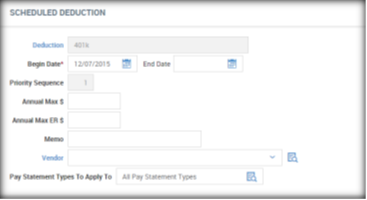

a. Scheduled Deduction section:

i. Begin Date- autofill with current date

ii. End Date- leave blank or add an end date (12/31/2020).

iii. Annual Max- Will stop deducting when this amount is met (normally left blank).

iv. Memo- Will show on the check stub

v. Vendor- Who the check is made out too

vi. Apply to all Pay Statements

Settings Section:

- Additional Info- Leave blank

- Employee section – Fill out amount to be deducted (flat or % of earnings).

- Frequency- Every Scheduled Pay

- Employer Section- Fill out if there is an employer deduction

- Block Last (3rd or 5th)- check to block withholding on 3rd biweekly payroll in a month

401K Frequency must be set up as “Every Pay” if you would like it to come out of 2nd checks, bonus checks, etc.

- Arrearage Settings- This can be left blank.

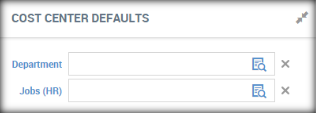

Cost Center Defaults- You can override the cost center that is associated with the employee. This field is normally left blank.

7. Select

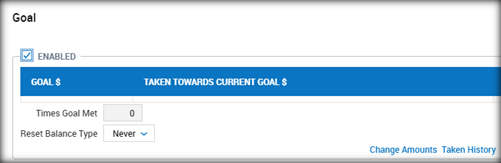

a. Goal- Enable the Goal feature in order to stop the deduction when the goal amount is met.

b. Check Mark the Goal Box

c. Select “Change Amounts”

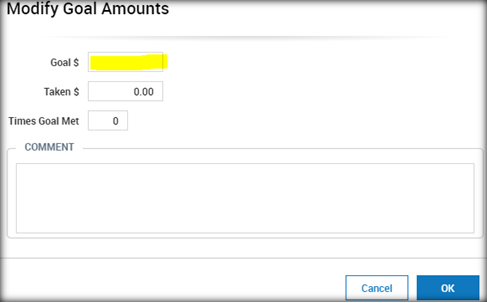

d. The following window will pop up. Enter goal amount, click OK

8. Select

9. Select to take you back to the employee’s Payroll tab.

to take you back to the employee’s Payroll tab.

10. Select to take you back to the employee list.

to take you back to the employee list.