If your employee would like to have an additional amount withheld from their state taxes, follow these instructions.

1. Navigate to: Select Menu  > My Team

> My Team  > Employee Information and select the applicable employee.

> Employee Information and select the applicable employee.

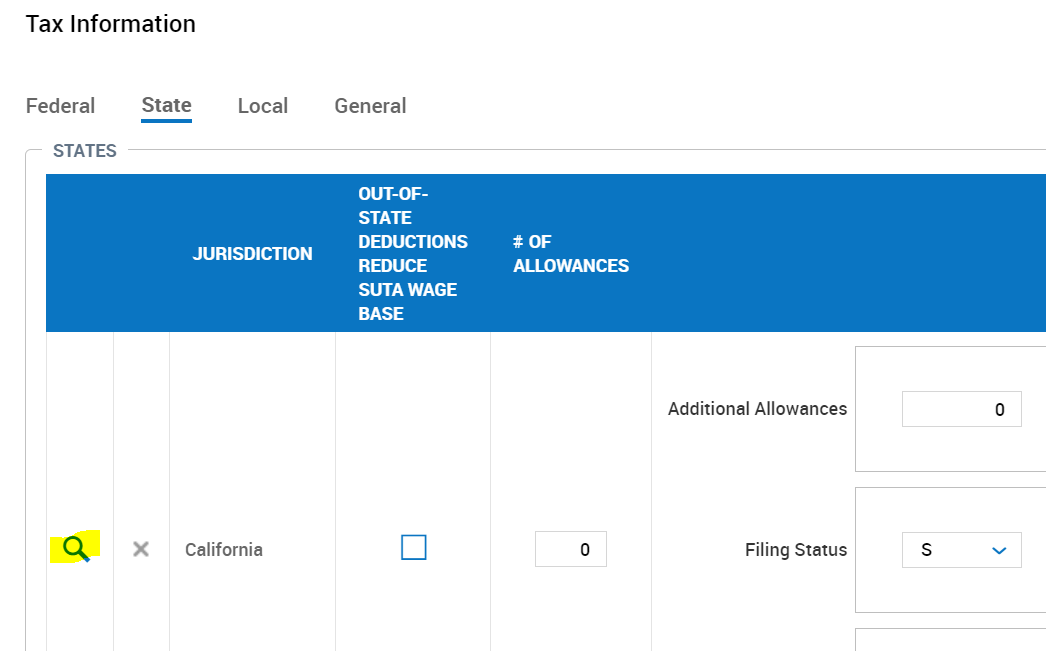

2. On the Payroll tab, scroll down to the Tax Information section and select the State tab.

3. Select the magnifying glass to view the state tax settings

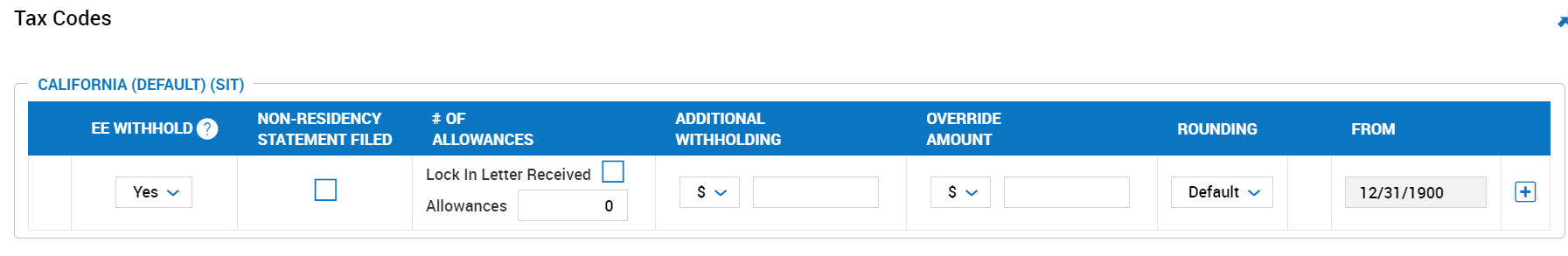

4. On the right side, look at the Tax Codes settings. The Additional Withholding section can be completed with an additional percentage or flat dollar amount. This will then be added to the employee’s state withholding for each payroll.

5. Select Save